“If you win,” Justice Amy Coney Barrett asked the lawyer arguing Wednesday against Trump’s emergency tariffs, “tell me how the reimbursement process would work. Would it be a complete mess?”

If, as expected, a majority of justices rule against the tariffs, it could be. But messiness is not a legal concept, and to whatever extent anti-messiness drives jurisprudence, Anita Krishnakumar of St. John’s Law School argued in a 2012 law review article, that itself can be kind of a mess. Barrett’s messiness aversion was nowhere in evidence when she voted to overturn a woman’s right to abortion, four years ago, in Dobbs v. Jackson Women’s Health Organization. Talk about a mess! That decision led to an increase in infant mortality and a rise in sepsis as high as 50 percent in states that enacted abortion bans. That was attributable to ob-gyns fleeing these states and a new fear, in emergency cases, of legal liability among the ob-gyns who remained.

Barrett will likely overcome her misgivings and, with Chief Justice John Roberts and perhaps Justice Neil Gorsuch, join Justices Elena Kagan, Sonia Sotomayor, and Ketanji Brown Jackson in overturning Trump’s emergency tariffs. The resultant mess Barrett fears is lost revenue. Since August, these tariffs have been pulling in an additional $20 billion or so per month, or $240 billion on an annualized basis.

Any thoughts on how we can clean up this mess? The supporters trailing Zohran Mamdani across the Brooklyn Bridge earlier this week had a pretty good one. “Tax the rich!” they chanted, and now Mamdani is mayor-elect of New York City. But instead of begging Albany, let’s do it in Washington, D.C.

I’m assuming Trump’s emergency-tariff revenue, which hasn’t completely stopped rising, will level off at $25 billion per month. (I exclude here the $10 billion per month that legal tariffs have pulled since before Trump declared “Liberation Day” in early April.) That means, on an annualized basis, the surplus revenue that will need to be replaced is more like $300 billion. Meh, I’ve seen bigger messes. We could confiscate $300 billion from Elon Musk tomorrow and he’d still be left with $187 billion to cover living expenses (and that’s before his trillion-dollar pay package kicks in).

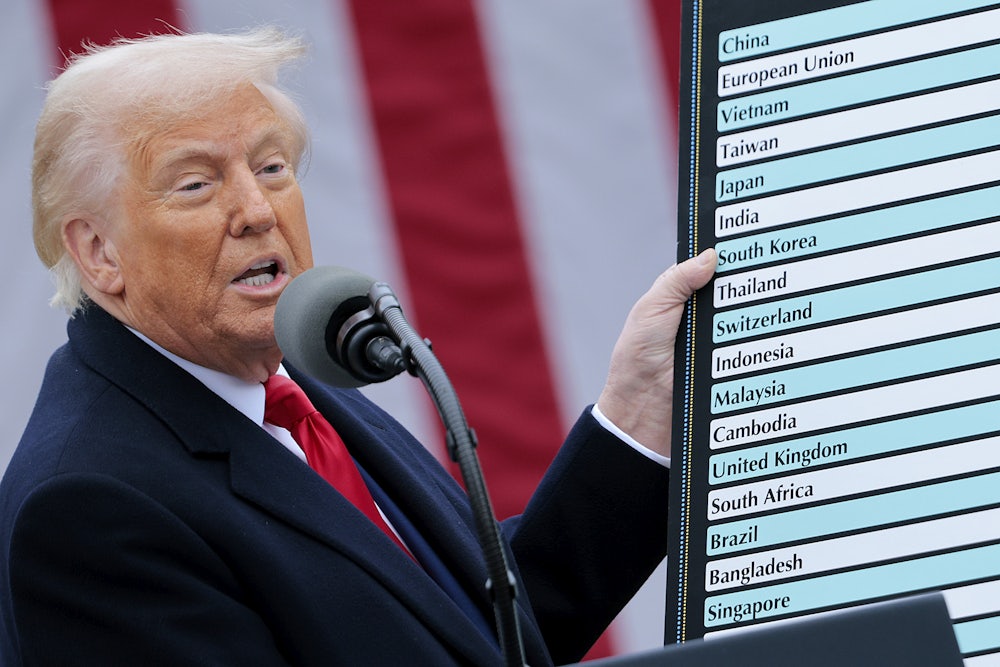

In his oral argument before the Supreme Court, Solicitor General D. John Sauer insisted that Trump’s emergency tariffs were never intended to raise revenue; instead, they were meant to regulate foreign trade. Sauer had to say this because Trump’s emergency tariffs rely on a statute (the 1977 International Emergency Economic Powers Act) that allows the president to regulate trade but doesn’t mention tariffs anywhere in its text. But Trump gave the game away in his 2025 inaugural address, when he said, “Instead of taxing our citizens to enrich other countries, we will tariff and tax foreign countries to enrich our citizens.” Trump even spoke of creating an “External Revenue Service.”

Trump’s dream of replacing the income tax in its entirety with tariffs, in addition to being outrageously regressive, is ridiculous. To achieve it, Trump’s tariffs would have to raise not $300 billion in surplus revenue per year but $3 trillion, which is what the Treasury raised last year from individual and corporate income taxes. (And that doesn’t even count $1.7 trillion in payroll taxes.) Imports last year totaled about $3 trillion, so replacing the income tax with tariffs would require slapping a 100 percent tariff on every item imported to the United States.

What is not ridiculous is replacing $300 billion in excess tariff revenue that ceases to be available. You can get there by dusting off various tax proposals that President Joe Biden offered but never got enacted. He was, regardless of what Trump says, a very good president.

Raise corporate taxes. When Donald Trump was first elected president in 2016, the top corporate tax rate was 35 percent. Trump lowered that to 21 percent. Biden proposed raising it to 28 percent, still well below where it stood before Trump. Doing so, the Treasury Department estimated, would raise, on average, $135 billion per year. It’s a start.

Increase the excise tax on stock buybacks. In 2022, Biden imposed a 1 percent excise tax on stock buybacks. The following year, he proposed quadrupling that to 4 percent. At the time, I wrote that Republicans would be fools not to favor this increase, because corporations were spending more on buybacks than they were on capital expenditures. Had the bill passed, that would have been another $14 billion in annual revenue, which brings us up to $149 billion. We’re halfway there.

Increase the top marginal tax rate. The top marginal tax rate is currently 37 percent on income exceeding $609,351 (for married people filing jointly, $731,201). All of these people are in the top 1 percent in income distribution, and they’re getting away with murder. Biden proposed raising the top marginal rate to 39.6 percent, which is where it stood before Trump lowered it in 2017. That would raise about $24 billion. So now we’re at $173 billion.

Representative Alexandra Ocasio-Cortez, Democrat of New York, has proposed adding another tax bracket of 70 percent on income over $10 million. It’s an excellent idea—the top bracket was 70 percent throughout the 1970s—and very much what Mamdani’s marchers had in mind. If we implemented AOC’s proposal, that would raise $70 billion per year and we’d almost be done.

But I promised to stick to Biden proposals. Let’s leave AOC’s idea for some future date when we have to address the $4 trillion 10-year deficit hole left by Trump’s “big, beautiful” reconciliation bill. It will definitely come in handy then.

But before I quit spitballing: Steve Bannon, of all people, once proposed raising the top rate to 44 percent on income above $5 million. That’s also a good idea. According to the nonprofit Tax Foundation, it could raise as much as $26 billion per year. Let’s put that in our back pocket for future needs.

Minimum 20 percent income tax on households whose wealth exceeds $100 million. Biden proposed that this tax be extended not only to income but also to capital gains—including unrealized capital gains. The latter aspect made it controversial, and some people called it a wealth tax. (I’d call it an “unrealized income gain” tax.) Biden later proposed the same idea not for hundred-millionaires but for billionaires. I prefer the original. It would raise $36 billion, on average, per year. Now we’re up to $209 billion in savings. Only $91 billion to go!

End tax preference for capital gains. I’d end this preference entirely and tax labor and capital at the same rate, just like that socialist Ronald Reagan did back in 1986. Biden proposed ending the capital gains preference only for people earning above $1 million. Biden also proposed ending the “angel of death” loophole whereby heirs who sell a house they inherited from Mom and Dad escape paying capital gains tax on its appreciated value since Mom and Dad bought it. Conceivably, Congress didn’t adopt this proposal because legislators didn’t understand it; it came with a truckload of caveats and exclusions. Savings: $17 billion. Now we’ve got $226 in savings.

Tighten the $1 million limit on deductions corporations can claim for compensation. This deduction limit is already in place, but Biden’s proposal expanded the number of employees at a given firm to which it would apply, and also extended the limit to private C corporations. Savings: $27 billion. Now we’ve got $253 billion in savings.

Increase Medicare tax for income over $400,000. The Medicare part of the payroll tax, unlike the Social Security part, is somewhat progressive; it rises from 2.9 percent to 3.8 percent for income above $250,000, and it also taxes net investment income for this cohort at the same 3.8 percent. This wrinkle was introduced in the 2010 Affordable Care Act. Strangely, Republicans have always been too busy screaming about other, much less left-wing parts of the law ever to notice this part. Biden proposed creating a new bracket for income above $400,000, with a 5 percent tax on income and a 5 percent tax on net investment. Savings: $80 billion.

We are now arrived, ladies and gentlemen, at $333 billion, which is actually $33 billion more than we need. It’s always nice to have a little cushion.

Biden couldn’t get any of these excellent proposals through Congress because Congress didn’t want to raise taxes by $330 billion. But Trump mooted that objection. He came in and raised taxes by $300 billion, only he didn’t ask Congress and he called these taxes “tariffs.” At oral argument, not even the most conservative Supreme Court Justices appeared to be deceived that tariffs are anything other than taxes.

If, as expected, the Supreme Court throws out Trump’s emergency tariffs, the United States will have to find $300 billion in missing revenue. Why not replace $300 billion in regressive tariffs that screw consumers with $330 billion in progressive taxes that sock the rich? This isn’t a mess, Justice Barrett, it’s an opportunity! If the Republican Congress is too dumb to see it that way, Democrats can explain it to midterm voters instead.