Just as Bob Seger found himself on the road again, Congress must once more raise the country’s borrowing cap before it defaults on its debts and makes the economy go kaboom. If this sounds familiar to you, this is because the nation edged toward the brink of default just a few short weeks ago. In October, Congress passed a stopgap measure to raise the cap, known as the debt ceiling, by $480 billion to give the country borrowing power through early December. But we are once again approaching the ominously named “X Date” on which the country will default, and there’s no clear plan for addressing the problem. Turn the page.

Treasury Secretary Janet Yellen informed lawmakers in a letter earlier this month they risked default if they did not raise the debt ceiling by mid-December. “While I have a high degree of confidence that Treasury will be able to finance the U.S. government through Dec. 15, there are scenarios in which Treasury would be left with insufficient remaining resources to continue to finance the operations of the U.S. government beyond this date.” The Bipartisan Policy Center, or BPC, estimates that the X Date will fall between mid-December and mid-February, although there is a “greater likelihood than usual that the X Date will fall towards the front portion of BPC’s range.”

The nearness of the X Date is thanks in part to the recent passage of a bipartisan infrastructure bill, which requires the Treasury Department to transfer $118 billion to the Highway Trust Fund by December 15. The agency has hitherto been employing “extraordinary measures” to avoid default. “The clock has always been ticking, but it just jumped ahead an hour,” said Shai Akabas, the director of economic policy at the Bipartisan Policy Center, in a statement announcing the center’s estimate for the X Date.

Lawmakers passed a short-term boost to the debt limit in October along party lines, after weeks of brinkmanship. The period before this agreement saw an increase in interest rates on short-term Treasury securities, signaling anxieties in the market that the United States would not be able to pay its debts. Nearing the X Date also risked having credit agencies downgrade the country’s credit, a possibility that could repeat itself should Congress again decide to dither in addressing the problem.

Before we get into the politics involved, let’s talk about the consequences of failing to raise the debt limit. Because the country has never defaulted on its debts, as this would be a catastrophically stupid thing to do when it can be so easily avoided, we don’t know for sure what would happen if Congress messes this up. But it’s sufficient to say that whatever might happen would be extremely bad. The Treasury Department would not be able to make payments on priorities such as Social Security, military and federal salaries, Medicare reimbursements, and veterans’ benefits. It would also risk spinning the economy into a recession and send further shockwaves through the global economy. Even if the country doesn’t default, just straying close to the X Date makes the market antsy, threatens the dollar’s status as the world’s reserve currency, and raises the cost for taxpayers.

Now that we have impressed upon you the seriousness of the issue, let’s take a gander at the political situation. Republicans do not want to help Democrats raise the debt limit and refused for weeks to supply the necessary votes to do so. Republicans could have just opted not to filibuster a debt ceiling hike, thus allowing Democrats to pass it with a simple majority, but they insisted it was the responsibility of the majority party. (Never mind that the debt was accrued by both Republican and Democratic administrations and that the Democratic House majority agreed to help a Republican administration to raise the ceiling in 2019.) Republicans say they don’t want to give Democrats cover to continue spending, even though raising the limit does not spend any new money or incur any additional debt but rather covers previous spending by Congress.

Republicans argued that Democrats could raise the limit on their own through budget reconciliation, the complicated and arduous process through which the majority party is currently attempting to pass President Joe Biden’s massive social spending bill, the Build Back Better Act. Democrats refused, claiming that doing so would take too long.

The clock ticked down until there were mere days before the country was set to reach the X Date, and then the aforementioned short-term agreement was reached. Republicans mustered the votes necessary to advance the $480 billion boost. (In case you need a refresher: Most legislation requires 60 votes to advance in the Senate, Democrats have a 50-seat majority, therefore support from at least 10 Republicans is required.) Senate Minority Leader Mitch McConnell argued that Democrats could now use this valuable time to raise the debt ceiling through reconciliation, a proposal that some House Democrats seemed open to but that Senate Democratic leadership steadfastly resisted.

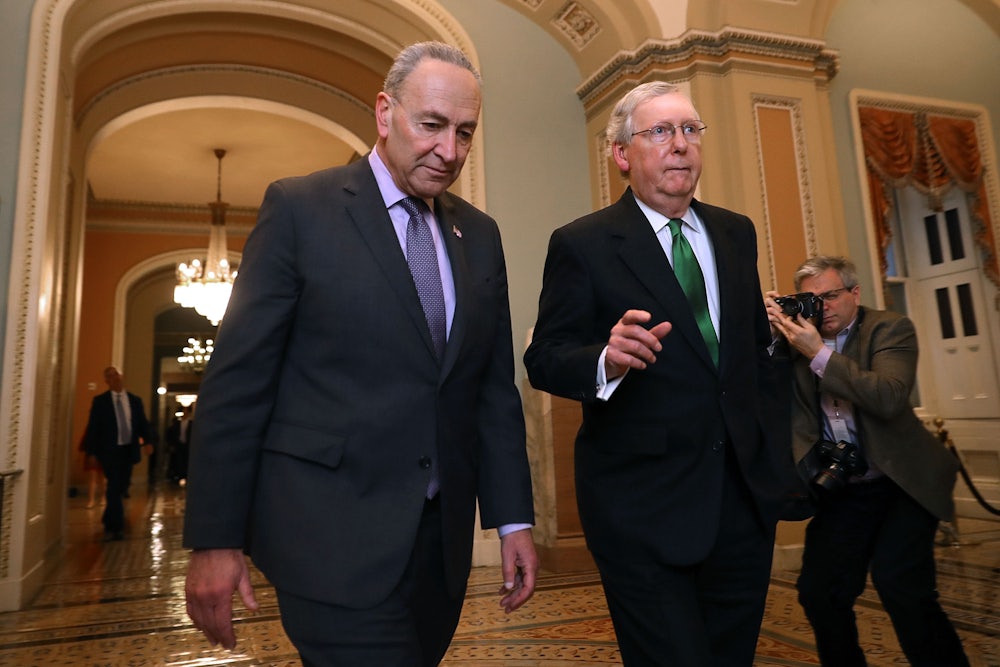

“We are focused on doing this in a bipartisan way,” Senate Majority Leader Chuck Schumer said earlier this month.

However, there appears to have been a cooling of temperatures in recent weeks. Neither party wants the country to default on its debts, and leaders seem keen to avoid another impasse. McConnell met with Schumer in his office earlier this month to discuss the issue, in a marked departure from earlier this fall, when the two leaders did not meet during the height of the standoff. McConnell told reporters afterward that it was a “good discussion” and that the two “agreed to keep talking and working together.”

Schumer told reporters on Monday that “hopefully we can come to an agreement to get this done.” Democratic Senator Debbie Stabenow estimated that the issue would be addressed “probably next week.”

A seemingly obvious solution would be to attach a debt ceiling hike to a continuing resolution, or C.R., to keep the government funded. Congress in late September passed a C.R. to keep the government funded through December 3, which means that it needs to pass another one by Friday to avoid a shutdown. In theory, it could kill two birds with one stone by dealing with both issues in one C.R. But Republicans previously torpedoed a C.R. that included a debt limit hike, and it doesn’t seem as if enough has changed to make that option suddenly appealing to them.

Some Republicans have floated an expedited reconciliation process. GOP Senator Pat Toomey, a proponent of the expedited reconciliation proposal, told reporters on Monday that it could be a “48-hour exercise”—skipping the arduous debate and marathon voting sessions that characterize the process. But expediting the process would require unanimous consent from all 100 senators, and it’s as yet unclear if all Republicans would agree to do so. Senator Joe Manchin told reporters on Monday that “there was an agreement from the Republicans to do a very quick reconciliation by itself for the debt ceiling only.” But Democratic leadership has been resistant to this idea.

Tacking the debt limit increase onto the reconciliation bill also means hiking it by a specific number. Congress has recently tended toward suspending the debt ceiling, which kicks the can down the road such that the country can continue borrowing for a period of time but hit the ceiling on a certain date, and is more politically palatable than hiking the limit by an actual number. It’s unclear whether the Senate could suspend the debt ceiling under reconciliation—as GOP Senator John Thune said Monday, that’s a question for the Senate parliamentarian, an expert on the chamber’s rules.

Democrats are hoping that Republicans will once again offer the necessary votes to move forward on suspending the debt limit, but this too may be wishful thinking. McConnell was criticized by some Republicans, including former President Donald Trump, for even helping Democrats proceed with a short-term extension.

Republicans could also agree to let Democrats proceed to a final up-or-down vote on a long-term fix without filibustering it, as long as Democrats agree to raise the limit by a fixed number rather than suspending the debt ceiling to a later date, such as after the midterm elections. But it’s uncertain whether a sufficient number of Republicans would agree to this solution.

Congress could take a time machine back to the halcyon days of 2011, which saw the passage of the Budget Control Act, marrying a debt limit increase to spending reforms. But the Budget Control Act was the culmination of months of negotiations, and Congress needs to get something done in a few weeks. Republicans might agree to another short-term extension contingent on opening negotiations on deficit-reduction measures, but again, this solution may not garner enough support from Republicans or even from Democrats resistant to using the debt limit as a bargaining chip.

It’s unlikely that Democrats will weaken the filibuster in order to pass a debt limit extension without Republican help, as Senators Kyrsten Sinema and Manchin have remained adamant in their opposition to doing so. Republicans are also hoping to avoid any change to the filibuster, which means ensuring that Manchin and Sinema don’t waver in their position. A looming debt default may be a convincing argument for changing filibuster rules, which is another reason Republicans may wish to circumvent that scenario. (In October, McConnell reached out to Manchin and Sinema to discuss his proposal for a short-term debt ceiling hike before he talked to other Democrats, Politico reported.)

But the debt limit is far from the only issue Congress must address before the end of the year. There’s the aforementioned December 3 deadline to fund the government, followed by continued negotiations on larger appropriations bills. Congress must also pass the annual National Defense Authorization Act, or NDAA, the $768 billion measure to authorize defense programs. The Senate is hoping to finalize the NDAA this week, which will involve sifting through hundreds of amendments and may include votes on dozens of them.

On top of all this, Schumer has also said that he wants to complete work on the Build Back Better Act by Christmas, a highly ambitious proposal even if the Senate didn’t also have to raise the debt limit, fund the government, and authorize key defense programs. The House passed its version of the bill earlier this month, but the nearly $2 trillion measure is likely to be changed significantly in the Senate, thanks to concerns from some senators and the need to hew to the complicated rules of passing legislation through reconciliation.

“As you can see, we still have much work to do to close out what will be a very successful year of legislative accomplishments,” Schumer said in a letter to Democratic colleagues outlining the Senate’s agenda earlier this month. “I am confident we can get each of these important items done this year, but it will likely take some long nights and weekends.”

As Stabenow put it to reporters on Monday, “We could be here every weekend from now until Christmas. So, sorry.”

Even considering long nights and weekends, time is running out for Congress to raise or suspend the debt ceiling. Nevertheless, McConnell appeared unconcerned about the issue when speaking to reporters earlier this month.

“We’ll figure out how to avoid default,” McConnell said. “We always do.”