Trump May Need to Find a Less Shady Backer for His Fraud Bond

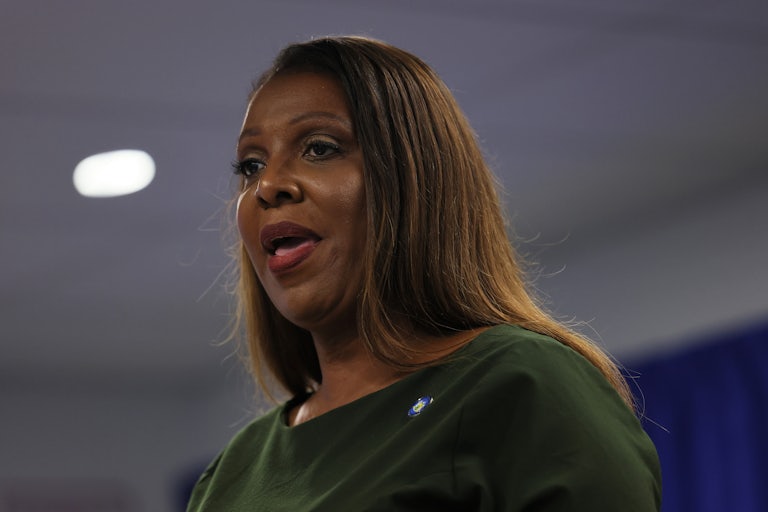

New York Attorney General Letitia James does not believe Knight Specialty Insurance is up to the task.

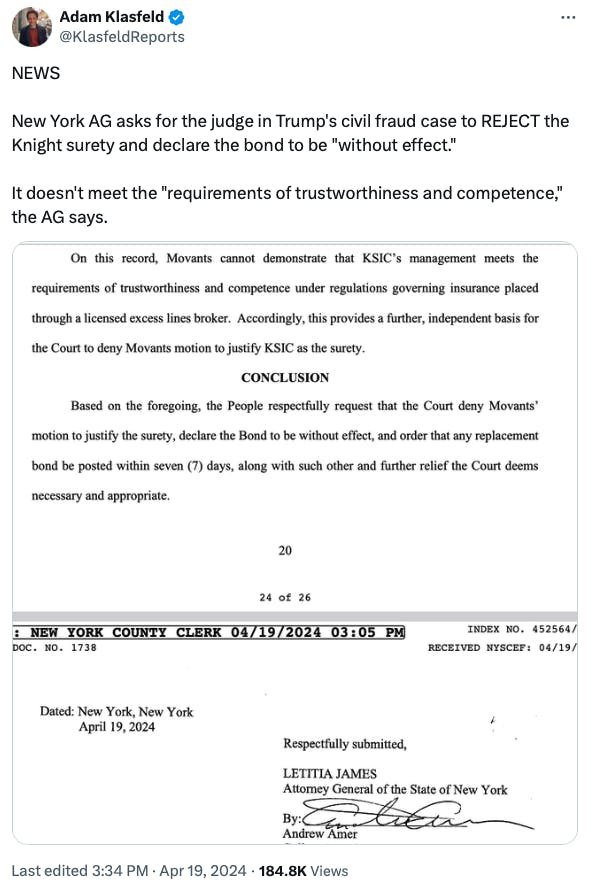

New York state Attorney General Letitia James on Friday asked the judge presiding over Donald Trump’s civil fraud trial to reject the former president’s bond, which has been dogged by reports of the insolvency of the company backing it.

Earlier this month, James gave Trump and Knight Specialty Insurance, the insurance company that underwrote his civil fraud case bond, 10 days to guarantee that the $175 million surety could be justified. Those 10 days are now up.

Trump and Knight Specialty Insurance, which is not licensed as a surety in New York state, could not prove the surety “meets the requirements of trustworthiness and competence,” according to a memo from James’s office, and thus failed to demonstrate that they would be good for the $175 million.

It’s not exactly a surprise, given that the bond would account for more than a third of Knight Specialty’s assets and more than its surplus funds. The company may also have not actually legally agreed to pay the bond for Trump. Trump has struggled to come up with the money to pay the various legal fees against him on his own; he enlisted the insurer Chubb to loan him the $91 million needed for the E. Jean Carroll defamation judgment.

As a result, James wants to give Trump a week to post another bond, this one backed by someone more trustworthy than the “king of subprime car loans.” If he cannot, James may begin seizing his assets to cover the judgment against him.

Judge Arthur Engoron is set to hear arguments on the surety’s validity on Monday. Trump, meanwhile, won’t be far: His criminal hush-money trial, which now has a full jury, is set to proceed in New York the same day.