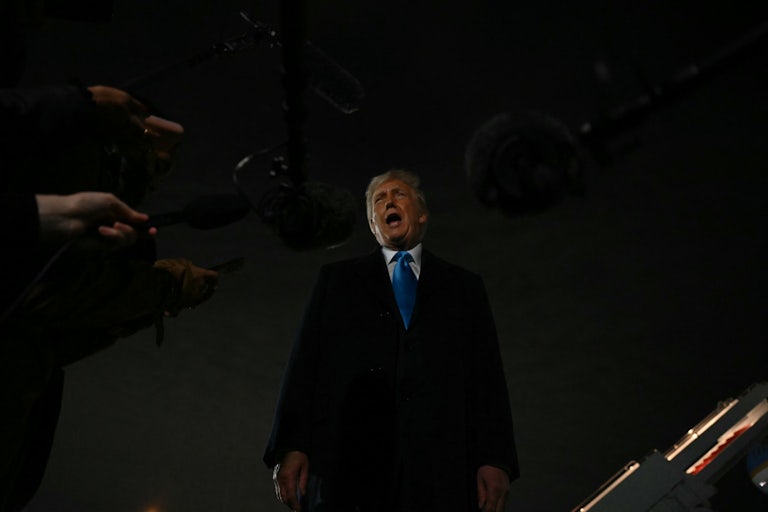

Stock Market Plummets as Trump’s Extreme Tariffs Take Effect

As Donald Trump’s trade wars begin, the stock market is quickly crashing.

The stock market took a downturn Monday morning after Donald Trump’s planned tariffs went into effect at midnight Monday.

The Dow Jones Industrial Average, Nasdaq, and S&P 500 all hit two-week lows of 43,921, 19,196, and 5,932, respectively. High performing companies like Apple and Nvidia slumped, along with American car companies like General Motors and Ford. Investors fled to safer investments like bonds and gold, with the precious metal jumping in value.

The markets are struggling with Trump raising 25 percent tariffs on Canada and 10 percent on China. Trump had also planned to impose 25 percent tariffs on Mexico—but announced a one-month delay at the last minute on Monday. Still, the news wasn’t enough to save the stock market from plunging.

Canada has retaliated with 25 percent tariffs of its own on $107 billion of U.S. goods, with tariffs on $20.4 billion worth of goods on Tuesday and the rest following within 21 days. Prices on everything from beer to gas have gone up in the U.S. The Canadian province of Ontario is banning American companies from contracts with the province, including a $68 million contract with Elon Musk’s Starlink company to deliver high-speed internet to remote areas.

Meanwhile, China pledged to take “necessary countermeasures to defend its legitimate rights and interests” on Saturday, including bringing a case against the U.S. at the World Trade Organization.

This morning’s market plunge comes after stocks took a dive Friday after the Trump administration announced that he would sign an executive order on tariffs the next day, sparking fears among investors. Those fears will not be easily assuaged in the coming days, as the full scale of Trump’s ill-thought economic plans have yet to hit Americans.