When the Covid-19 pandemic spurred school closures across the country, parents like Pasqueal Nguyen, a mother of seven in Youngsville, Louisiana, needed to ensure their children were still receiving a sufficient education. Two of Nguyen’s children, who now range ages three to 16, also have special needs, complicating efforts to provide care at home.

So Nguyen, a child welfare consultant, was grateful for the monthly checks her family received last year as part of the expanded child tax credit. They used the credit for necessities such as groceries, gas, child care assistance, and school supplies. But when the program expired at the end of last year, that loss brought sacrifices, such as removing her son from a day care program.

When I spoke to her earlier in December, Nguyen told me that she hoped the credit would be reinstated, and that she would put her son back in day care if it were implemented in the near future, before he starts preschool. “Even though the pandemic is kind of going away, the repercussions from it, with all the high amount of money that everyone’s being charged for food and gas and everything else—[the credit] would even things out for families,” she said.

The American Rescue Plan, passed in March 2021, implemented three major changes to the child tax credit: increasing the amount to to $3,600 for children aged 5 and under, $3,000 for children between ages 6 and 17 for households making under a certain threshold; disbursing the credit in monthly installments; and making it fully refundable—that is, accessible for families with low or no income. The monthly payments began in July 2021, and expired at the end of that year due to congressional inaction. Families received the remainder of their credit as a lump sum during tax season this year.

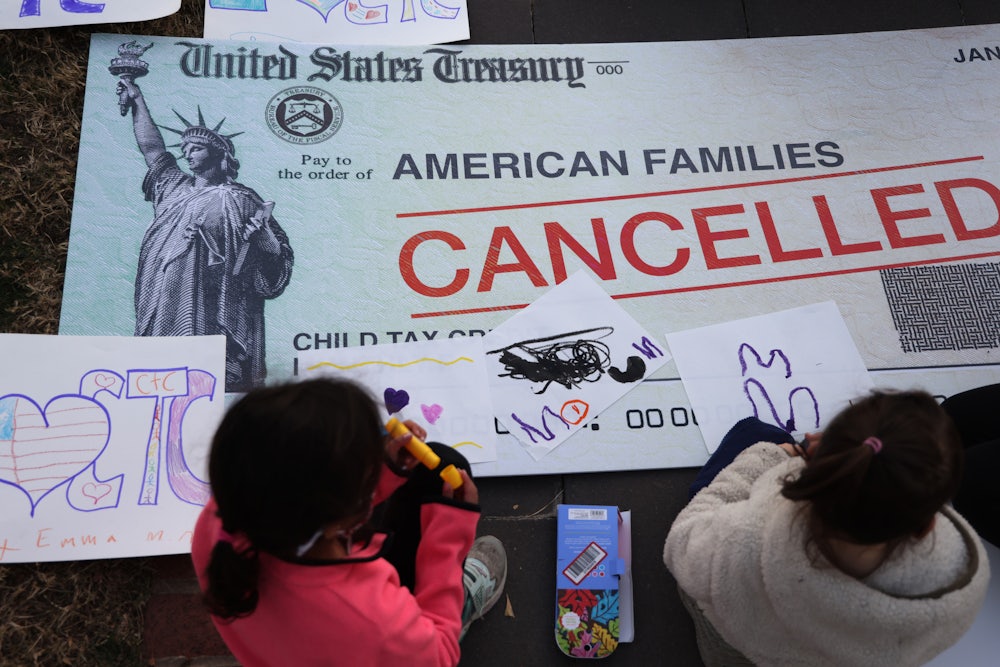

One year after its expiration, the loss of the expanded child tax credit is still affecting families. The credit reverted to its pre–American Rescue Plan status, offering $2,000 at most in a lump sum during tax time, and unavailable to the poorest children. Although some Democratic lawmakers in Congress insist that they will keep fighting to reinstate the enhanced credit, impending Republican control of the House will make any effort to do so a battle, less uphill than a sheer cliff.

For a moment, it appeared as if the expanded child tax credit might return from the brink of legislative death, with supporters urging for its inclusion in a package of end-of-year funding bills. But despite offering the carrot of business-friendly tax credits in exchange, Republicans did not budge in their opposition: The so-called omnibus, lacking the expanded credit, was signed into law Thursday by President Biden. The credit was implemented under extreme extenuating circumstances, but it appears that in more normal times, it simply lacks the sufficient support to be reinstated.

When I asked how it felt when the credit expired, Nguyen replied, “I can’t even put a word on it.” After pulling her son out of day care, she discovered that their family doesn’t meet the requirements for the state child care assistance program. “I’ll just say, it was devastating. It was harder. But we did what we had to do,” she said.

Representative Rosa DeLauro, the chair of the powerful House Committee on Appropriations, described the credit not only as an “antidote to inflation” but as an “affirmation” that the federal government understands the plight of parents. “They used it to insure their families were not just surviving, but thriving,” DeLauro, who has been an advocate for an expanded child tax credit for nearly two decades, told me earlier this month. “We were successful, and now … we’ve had this hiatus in which we’re noting that we’re not successful. We’ve gone backwards.”

The implementation of the expanded child tax credit was akin to a social experiment in real time, with almost immediate results. During the six months it was in effect, the credit reached more than 60 million children in 36 million households. Due in large part to the expanded child tax credit, child poverty was cut nearly in half in 2021 compared to 2022, according to the Census Bureau. Food insufficiency also decreased significantly among families with children, dropping from a rate of 11 percent to 8.4 percent after the first monthly payment was distributed in July 2021.

“We demonstrated that the richest country in the world doesn’t have to accept this level of childhood poverty as a permanent feature of our democracy or permanent feature of our economy,” said Senator Michael Bennet, one of credit’s most ardent supporters in the Senate, in a November interview. “What’s, in some ways, so terrible about our failure to extend the child tax credit is that unlike before we passed it, we actually know that it did what it was supposed to do. Now we have that evidence.”

Families primarily spent the credit on necessities, such as groceries, housing payments, and utilities. Ninety-one percent of low-income families spent the credit on basic household expenses, according to the Center for Budget and Policy Priorities. Elyssa Schmier, the vice president of government relations at the parent advocacy group MomsRising, argued that the child tax credit was also important for providing additional experiences that make childhood more fulfilling. “[Parents] are talking about being able to buy additional Christmas presents for their kids, being able to take their kids out to dinner once a month, maybe do a family vacation for the first time in years, sign their daughter up for a dance class,” Schmier said. “I would consider that [as] a parent being able to provide a full and varied upbringing for their child.”

The results of the credit’s expiration were as immediate as those of its implementation. January 2022 saw 3.7 million more children fall beneath the poverty line compared to December 2021. That increase was particularly dramatic for Black and Latino children: Following the end of the expanded child tax credit, there was a 28 percent increase in the child poverty rate for Black children, and a 40 percent increase in the child poverty rate for Latino children from December 2021 to February 2022. The expiration of the expanded credit was also associated with a 25 percent increase in food insufficiency for families with children.

“What’s so startling [is] that we know precisely where that credit went. Quite frankly, there are not a hell of a lot of programs in which we know where the money has gone,” said DeLauro, who will be the ranking member of the appropriations committee beginning in January.

Furthermore, unlike the expanded credit, the current child tax credit is not accessible to the lowest income families; roughly 19 million children—about one in four children under the age of 17—are thus once again ineligible for the full credit. Black and Latino children, as well as children living in rural areas, are disproportionately excluded from the credit.

“Since the child tax credit expired, a good portion of families with children basically saw a reversal of their well-being,” said Megan Curran, policy director for the Center on Poverty and Social Policy at Columbia University, who has written multiple reports on the credit. “The expiration of the child tax credit—combined with what else was happening in the economy at the same time with inflation—really has just posed a huge challenge throughout the entirety of 2022 for families across the country.”

Opponents of the credit raised concerns that it could discourage parents from working; there are conflicting studies as to the effect on work if the credit is made permanent. However, research using real-world data demonstrates that the credit had a negligible impact on recipients’ employment while it was in place. In some cases, the credit made it easier for parents to work, in part because they were using it to pay for child care.

Others were concerned about the potential inflationary impact of the expanded credit, but the credit may do more to help families handle rising costs than increase the federal deficit. In December, a group of more than 200 economists urged Congress to reinstate the program, arguing that “the expanded monthly refundable CTC, at under 0.4 percent of GDP, is too small to increase inflation, but it will help families meet rising costs.”

“The child tax credit payments are not big enough that they cause inflation to happen. They are big enough, though, to offset most of the inflation for very low-income families,” Elaine Maag, a senior fellow at the Urban-Brookings Tax Policy Center and expert on taxation of low and middle-income families, told me.

Despite the success of the policy in reducing child poverty, reinstating the expanded credit has been a sisyphean task for its supporters in Congress. Although Republicans as a whole remain largely opposed to the credit, there is some overlap in priorities; GOP Senator Mitt Romney has proposed his own child allowance plan that is, in some ways, more generous than the expanded credit enacted by the American Rescue Plan. Romney told me that he was willing to negotiate going forward, although he argued that a child tax credit should be offset by cuts to other programs. (Romney’s initial proposal would have cut the Temporary Assistance for Needy Families program.)

“There haven’t been any discussions yet, and I’m certainly anxious to have discussions going forward,” Romney said. “But unfortunately, some of our Democratic colleagues only feel they’ve accomplished something if they’ve added spending, as opposed to eliminating old spending and putting in place new programs to do a better job.”

However, most Republicans—and one Democrat—have nonetheless argued that there should be work requirements for the child tax credit. Maag noted that middle and high-income families had received the child tax credit for a quarter century, and received a tax exemption for dependents before that. “It did only seem to be an issue when we finally included the very lowest income children,” Maag observed.

In August, the slim Democratic majority in Congress managed to pass the Inflation Reduction Act, a large climate and health policy bill that contained several of the party’s priorities. But the measure was far smaller than the initial bill sought by President Joe Biden and most Democrats. That bill, the Build Back Better Act, included an extension of the child tax credit. Senator Joe Manchin, the moderate Democrat from West Virginia, personally opposed the credit, and torpedoed the Build Back Better Act last December.

Democrats had hoped to pass the Build Back Better Act through the process of reconciliation, which would allow them to avert a filibuster and pass the legislation with a simple majority. After wandering in the desert of a legislative stalemate for seven months or so, Manchin and Senate Majority Leader Chuck Schumer reached a deal on the Inflation Reduction Act—which conspicuously lacked many Democratic social priorities, the expanded child tax credit among them.

“I was very disappointed by that,” Bennet said about the exclusion of the child tax credit from the reconciliation bill. “And I’m sorry that I haven’t been able to persuade Senator Manchin of the benefits of this.”

With Republicans taking control of the House in January, these final weeks of the year represented the last chance for the foreseeable future for the Democratic majority in both houses to reinstate the credit. Democrats increasingly pushed the idea that they could tuck a provision reinstating the expanded credit into an omnibus package of bills funding the government, a quid pro quo in which the credit would be included in exchange for restoring research and development expensing for businesses, which had been changed by the 2017 tax cuts.

But Republicans—still disgruntled by the high levels of spending on social programs in the American Rescue Plan and the Inflation Reduction Act—resisted. When the text for the omnibus legislation funding the government was released, it included neither the expanded child tax credit nor any tax changes that Republicans had sought.

GOP Representative Kevin Brady, ranking member of the Ways and Means Committee, told me that “the cost [of the child tax credit] is so mismatched with our requests.” “Packaging has to be balanced, in policy and cost, and this one’s hard to balance,” Brady explained. Republicans also did not necessarily consider it a fair trade, noting that Democrats and Republicans have both supported an R&D credit in the past. The Committee for a Responsible Federal Budget estimates that reinstating the expanded child tax credit would cost $1.2 trillion over 10 years, while restoring R&D expensing would cost roughly $155 billion over a decade.

However, a cost-benefit analysis by Columbia University estimated that implementing the expanded child tax credit on a permanent basis would cost around $97 billion per year, but generate “social benefits” of $929 billion per year. Nguyen said that she believed the expanded child tax credit should be viewed as an investment, “like they invest in infrastructure.” “Who’s to say that families and parents wouldn’t be responsible and do the right thing with their money? Some people say that that’s an issue. But I think the real issue is that our families, our constituents are not trusted. And that’s just absurd.”

Senator Sherrod Brown, who has advocated for an expanded child tax credit for a decade, placed the blame squarely on Senate Minority Leader Mitch McConnell for the credit’s ultimate exclusion, maintaining that McConnell did not want to give the Biden administration another win after several landmark bipartisan bills passed during his first two years in office. “We could have done a number of good things that we weren’t able to accomplish, because in the end, McConnell’s caucus doesn’t want achievement, they want disagreement, they want inaction,” Brown contended.

Although a Republican majority will soon take the House, Schmier said that she believed that Democrats would continue to hold the line. “The deal that we supported, and the parameters around it for this go-around, which was a great deal on the table for Republicans—no corporate tax cuts without the inclusion of the child tax credit—that goes into the new Congress,” Schmier said. Indeed, Bennet said in a statement after the omnibus was released, “I will continue to oppose cutting taxes for corporations without passing an expanded child tax credit.”

Democrats also note that the Tax Cuts and Jobs Act, Republicans’ nearly $2 trillion package of tax cuts passed in 2017, expires in 2025. If Republicans want to return to the negotiating table to extend provisions from that legislation, the child tax credit could be a point of leverage. (The Tax Cuts and Jobs Act also increased the child tax credit from $1,000 to $2,000, meaning that the amount is set to drop even lower in 2025 unless action is taken.)

Despite its lapse, Senator Cory Booker—another champion of the child tax credit in the Senate—argued that this was the “most hopeful period” for the credit. After years of advocacy, the expanded credit had finally been implemented, if only for a brief time during a global pandemic and economic downturn. “It makes me really believe that as the pendulum of our politics often swings back and forth, the next time it swings our way, we now hold we’ll not only get it for a year, but we will be able to get it permanently,” Booker said. It is still unclear, however, when this “next time” might occur.