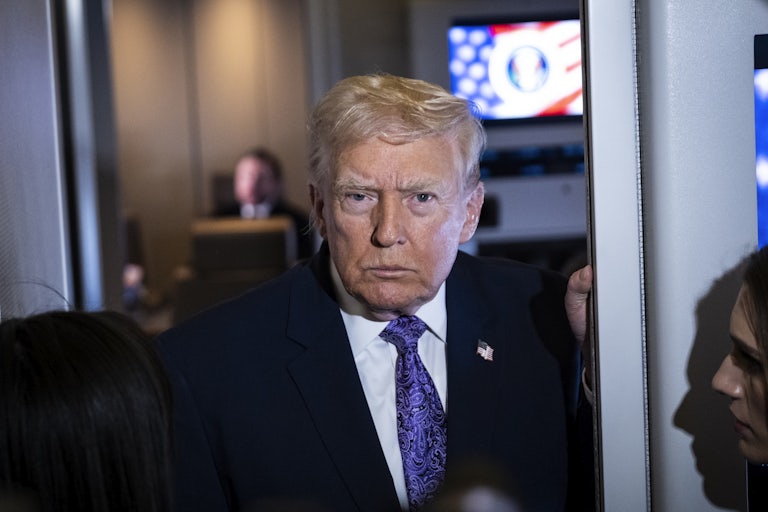

Trump Tried to Brag About Black Friday. The Truth Is Far More Grim.

A closer look at sales data gives a much darker picture of the economy.

President Donald Trump may want to celebrate a record number of Black Friday sales as a sign of a flourishing economy—but there’s a lot he’s not telling you.

The president shared an article on Truth Social Monday from conservative blog Just the News predicting that the 2025 holiday shopping season, which lasts between November 1 and December 31, would be the “first quarter trillion dollar season online in U.S. history.”

According to Adobe Analytics’s 2025 Holiday Shopping Report, U.S. shoppers spent a record $11.8 billion online on Black Friday, a 9.1 percent increase in online sales from the same day the previous year.

That’s a promising sign for Trump’s economy, right? Wrong.

Rising costs, driven by steadily rising inflation and the president’s disastrous tariffs, prevented retailers from offering better deals and kept discounts flat compared to 2024, Reuters reported. So while consumers spent more money on Black Friday than in previous years, shoppers checked out with far fewer items, according to Salesforce.

But that’s not all. Adobe also reported a significant increase in the use of Buy Now Pay Later, or BNPL, services, a financing option that allows consumers to pay off purchases in installments. The increased prevalence of services that accumulate consumer debt is nothing to celebrate, as it indicates Americans are experiencing mounting financial strain.

Adobe predicted that over the course of the holiday shopping season, American consumers would spend $20.2 billion using BNPL, an 11 percent increase from 2024. Consumers have already spent an estimated $7.5 billion using these services since the beginning of November.

Klarna, a popular BNPL service, announced Monday that sales using its “flexible payments” had increased 45 percent year-over-year between November 1 and Black Friday.

BNPL isn’t just for the holiday season—it’s already spread into routine, everyday spending. One economic survey from April found that 25 percent of Americans were using BNPL to pay for groceries, up from 14 percent in 2024 and 21 percent in 2023.

The choice to pay in installments may come crashing down on consumers’ heads soon. In June, FICO announced it would begin including BNPL loans in credit reports—meaning that a short-term splurge, like indulging in a few Black Friday “sales,” could potentially become a long-term mark on a borrower’s financial record.