Trump Press Secretary Flat-Out Lies About Effects of Budget Bill

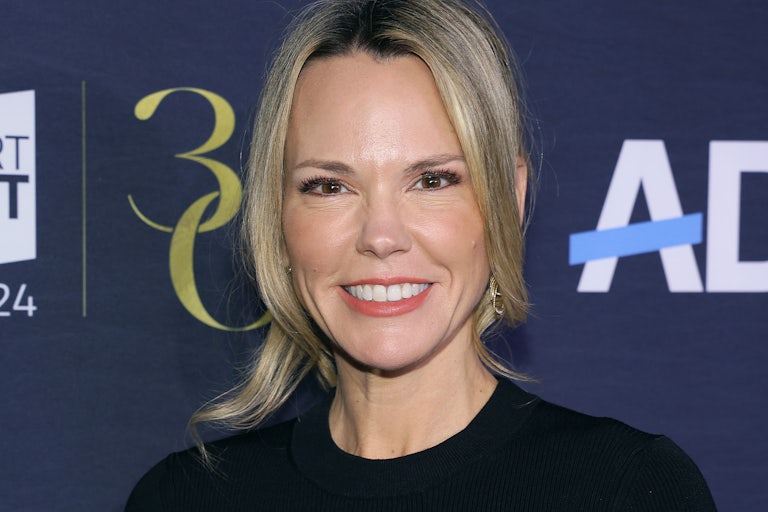

Karoline Leavitt insisted that Donald Trump’s tax cuts won’t affect the national deficit.

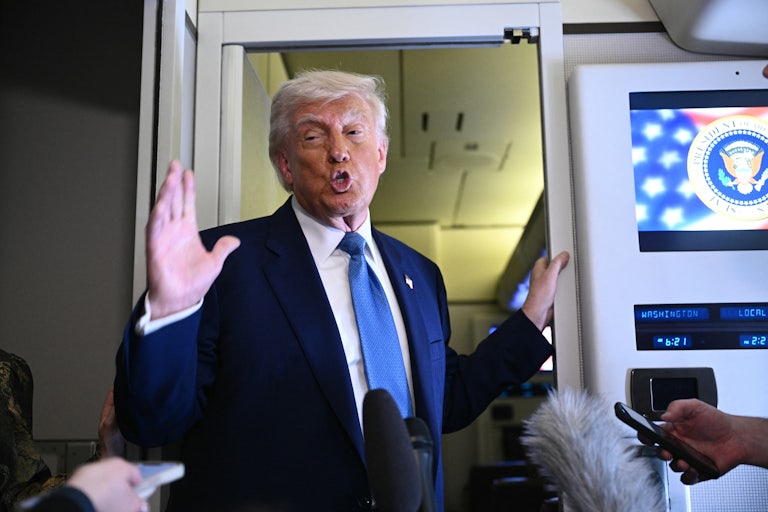

Republicans in the House Budget Committee passed Donald Trump’s “big, beautiful bill” on their second try late Sunday, advancing his 2017 tax cuts for multimillionaires and corporations closer to the House floor.

And by Monday morning, White House press secretary Karoline Leavitt was plainly lying about the impact of the forthcoming legislation.

“Is the president OK with this bill adding to the deficit?” a reporter asked.

“This bill does not add to the deficit. In fact, according to the Council of Economic Advisers, this bill will save $1.6 trillion, and the president absolutely understands and hears the concerns of fiscal conservatives and of Americans who want to get our fiscal house in order,” Leavitt responded.

“That’s what the intention of this bill is. There’s $1.6 trillion worth of savings in this bill,” she continued. “That’s the largest savings for any legislation that has ever passed Capitol Hill in our nation’s history.”

Where Leavitt acquired that number is not clear, but other, non-administration-related estimates say otherwise.

Trump’s tax cuts for corporations and multimillionaires is estimated to add trillions to the national deficit. The reconciliation bill’s final deficit price tag has yet to be determined, but last week, the Committee for a Responsible Federal Budget released a report indicating that the proposal was expected to add somewhere between $3.8 trillion and $5.3 trillion to the national deficit over the next 10 years. As of the time of publishing, the U.S. deficit is currently at $36.8 trillion.

To offset the hike, Republicans proposed cutting $880 billion from Medicaid by way of adding work requirements and booting undocumented immigrants off the public health coverage program (undocumented immigrants are ineligible to receive Medicaid, though lifesaving care under EMTALA can be covered by emergency Medicaid).

To alleviate the whopping deficit growth, the bill also didn’t follow through on things that Trump had promised to his base, such as stripping taxes from tips, overtime pay, and Social Security benefits.

The bill initially stalled Friday due to a far-right flank in the committee that remained skeptical of adding such a significant sum to the national debt. In a statement prior to the vote, Representative Chip Roy—who voted “no” last week but flipped his vote to “present” on Sunday—said that the bill fell “profoundly short.”

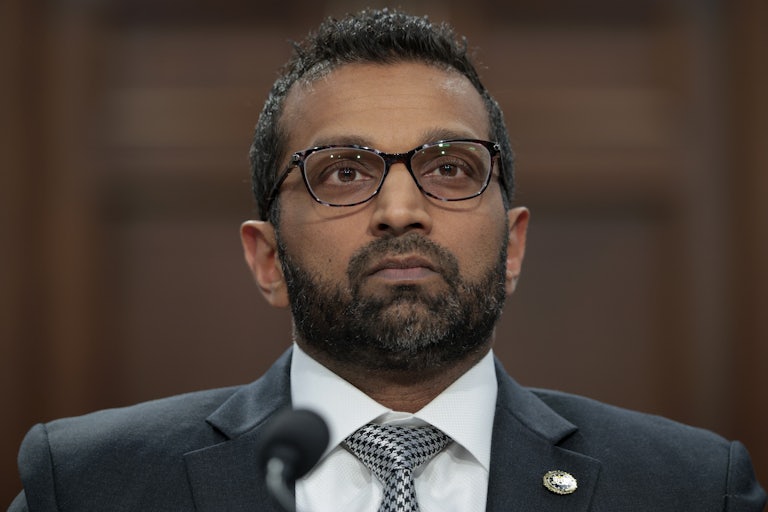

Stephen Miran, the chair of the Trump administration’s Council of Economic Advisers, is possibly best known for his plan to correct the U.S. deficit by weakening the dollar—something he’s dubbed the “Mar-a-Lago Accord.” Miran, a Harvard-trained economist, has other controversial theories that have made him an outlier among his peers.

In addition to his dollar-weakening stratagem, Miran has been a vocal proponent of Trump’s tariff plan, pitting him against dozens of Nobel Prize–winning economists who have warned since Election Day that the MAGA leader’s stiff tariff increases and tax cuts would spell disaster for the average American.

Columnists have labeled Trump’s bill the second coming of Reagonomics, promising to slash taxes for the wealthy while leaving the rest of the U.S. population to scramble for the trickle-down, a wealth distribution theory that economists, think tanks, and newspapers have concluded doesn’t “hold up.”