DOGE Staffer Fired the Lawyers Trying to Help Him Avoid Corruption

Lawyers warned one of Elon Musk’s DOGE cronies that his investments were a conflict of interest. He fired them.

A 25-year old DOGE bro oversaw the termination of lawyers at the Consumer Financial Protection Bureau last month, just days after they warned him certain stocks he owned were prohibited by employees, according to a Wednesday report by ProPublica.

Gavin Kliger had been detailed to the CFPB in early March as part of DOGE’s efforts to take over and ultimately dismantle the ethics watchdog that oversees banks and manages vast troves of consumer data.

But Kliger had committed a big no-no at the CFPB. His financial records indicated that he owned up to $365,000 in stock in companies that the CFPB was charged with regulating, including Tesla, which has been the subject of hundreds of consumer complaints. Kliger also owned stock in Apple and two cryptocurrencies, as well as additional companies on a “Prohibited Holdings” list, including Alphabet, Alibaba, and Berkshire Hathaway. In total, Kliger had made up to $715,000 in investments in seven barred companies.

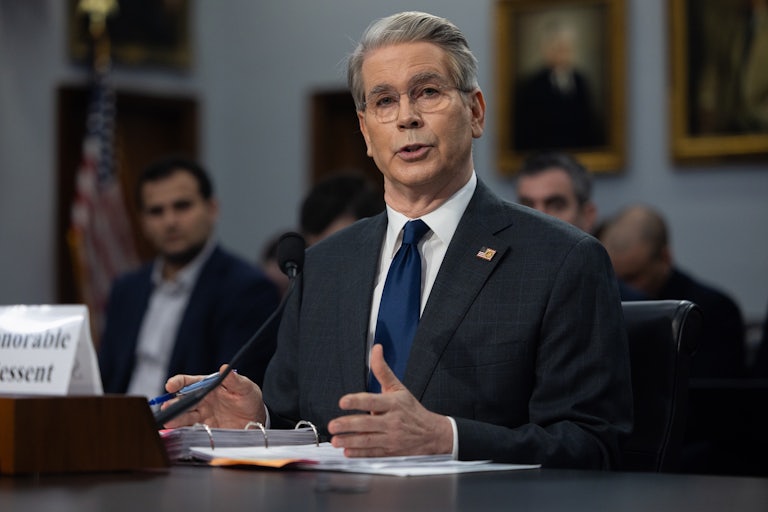

Kliger received an ethics notice on April 10, ProPublica reported. Shortly afterward, OMB Director Russell Vought moved forward with sweeping layoffs of federal employees, and sent Kliger and other DOGE officials an email with the subject line “CFPB RIF Work.” Another note sent to Kliger told him he’d been given access to the agency’s computer systems that “should allow you to do what you need to do.”

Kliger spent the next few days “screaming at people he did not believe were working fast enough” to disseminate termination notices, said one federal employee who used the pseudonym Alex Doe, in a sworn statement about the layoffs. On April 17, the termination notices went out, including to the ethics team, which had alerted Kliger to his prohibited investments.

A White House spokesperson told ProPublica that Kliger “did not even manage” the layoffs, “making this entire narrative an outright lie.”

In April, the CFPB fired nearly 1,500 employees at DOGE’s direction, leaving only about 200 people employed there. The remaining workers have been forced to work around the clock to manage the transition, and they’ve begun including themselves in the layoffs.